Providing Keys for Your Financial Success

(507) 451-1991

634 West Bridge Street, Owatonna, MN 55060

Probability of Success

When planning for retirement it is important to do our best to factor in things that are out of our control. While we always have control over the investments we purchase, we don't have control over how their performance will be and how that may impact us.

One of the main considerations that are overlooked when planning for retirement is "Sequence of Returns". To help explain my point we'll use a hypothetical example of a person who invests in an investment from January 1,1999 through December 31, 2016. During this 18 year time period the hypothetical compounded annual rate of return for this investment was 5.26% and a $100,000 investment would have been worth approximately $251,643.

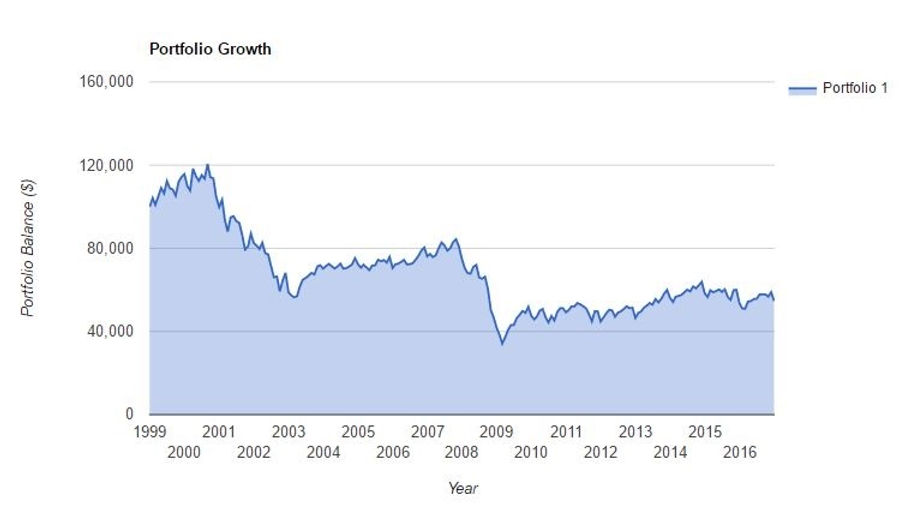

The Graph below shows a hypothetical example on how an investment may have done over 18 years.

If one didn't look into the details, a person may assume that if they had taken 5.26% or $5,260 from their account every year that they would still have their original $100,000 investment. The problem is that this hypothetical investment did not return 5.26% every year. In fact, in this example, the sample investment never returned 5.26%. Some of the returns were greater than 5.26% and some years had negative returns.

Below is a chart of what the investment actually would have done during this time period if you had been taking $5,260 annually.

As you can see because of market volatility you would have much less in the account than your original investment. Finding an investment mix that is appropriate for your specific situation will play a crucial part in your retirement income success.

If you don't have a financial plan, come talk to us so you can have a better idea of what your "Probability of Success" looks like. Remember, initial consultations are always complimentary.

This example is for hypothetical purposes only. It is not intended to portray past or future investment performance for any specific investment. Your own investments may perform better or worse than this example.